What The Market Recognizes As The Change In Value An Improvement Makes To A Property Is Called What?

What's the outlook for the Australian property markets for 2022 and beyond?

This is a common question people are asking at present that we have entered a new year.

Despite all the challenges Covid19 threw at the states and a sequence of lockdowns, Commonwealth of australia's housing markets experienced a once in a generation boom in belongings prices in 2021.

And even though the rate of house price growth is slowing, and our regulator APRA is keen to see the housing markets slow down, property values go along rising in nearly every market place around the country.

Over the past twelvemonth, Sydney house prices have risen over 25.v%, Melbourne xiv.9% and Brisbane 29.two%.

But the momentum in growth is showing signs of easing, since peaking in March final year.

Source: CoreLogic, April 1st 2022

Now I know some potential buyers are asking "How long tin can this terminal? Will the property market place crash in 2022?"

They must be listening to those perma bears who keep telling anyone who'due south prepared to listen that the property markets are going to crash, simply they've made the same predictions twelvemonth after year and have been wrong in the past and will be wrong again this time.

What'due south ahead for property values in 2022?

The final few years take shown us how hard it is to forecast belongings trends…merely here goes – I'm going to share a number of holding predictions for 2022.

1. Continued belongings price growth

Property values will go along rising in 2022, but non everywhere and not to the same extent as they have over the last ii yr.

Nosotros're heading into a period of strong economic growth, jobs are beingness created and business organisation and consumer confidence is loftier.

The risks to farther toll growth include unforeseen consequences from Coronavirus, rising involvement rates (unlikely for another year or two) of tightening of lending by APRA. Nevertheless, it's unlikely that we will continue to run into the aforementioned rate of growth over the next two years that nosotros have seen over the past two years.

While most belongings markets around Commonwealth of australia have performed strongly then far this cycle (other than the inner city of high-ascension apartment marketplace), moving forward the rate of property price growth volition slow and there are several reasons for this including:

- Affordability issues will constrain many buyers.

The impetus of low-interest rates allowing borrowers to pay more has worked its way through the system and with belongings values beingness twenty- 30% higher than at the get-go of this cycle at a time when wages growth has been moderate at all-time and minimal in real terms for most Australians, this means that the boilerplate home buyer won't have more money in their pocket to pay more for their home. - The pent-upward need is waning.

While in that location are ever people wanting to move business firm and many delayed their plans over the last few years because of Covid, there are simply so many buyers and sellers out there and there volition be fewer looking to purchase in 2022. - APRA – is intent on slowing our markets using macro-prudential controls

ii. We will feel a two-tier property market.

In other words, not all locations will continue growing strongly moving forrard.

I can see properties located in the inner and centre-ring suburbs, specially in gentrifying locations, significantly outperforming cheaper properties in the outer suburbs.

While the outer suburban and more than affordable cease of the markets have performed strongly so far, affordability is at present becoming an effect as the locals have had minimum little wages growth of the time when property prices have boomed.

In these locations, the residents don't have more than money in their pay packet to pay the higher prices the properties are at present achieving.

More than that, Covid19 has adversely afflicted depression-income earners to a greater extent than middle and high-income earners who are likely to recover their income dorsum to pre-pandemic levels more chop-chop, while many accept non been hit at all.

And every bit we start to emerge from our Covid Cocoons in that location will be a flight to quality properties and an increased emphasis on liveability.

Equally their priorities change, some buyers will be willing to pay a little more for backdrop with "pandemic appeal" and a little more than space and security, but information technology won't be but the holding itself that will demand to meet these newly evolved needs – a "liveable" location will play a big part too.

Those who can afford it will pay a premium for the ability to work, live and play inside a 20-minute drive, cycle ride or walk from dwelling house.

They will look for things such as shopping, business services, education, customs facilities, recreational and sporting resource, and some jobs all within 20 minutes' attain.

Now, this is goose egg new…

The high end of our holding markets outperformed in 2021, even though this segment of the market is at present slowing a little.

This chart shows the rolling quarter growth in the different tiers of our housing markets.

These indices represent the value changes in the bottom 25% of the market place values (lower tier) the center fifty% of values (heart tier) and the summit 25% of values (loftier tier) across the combined uppercase city housing markets.

The strongest level of growth (every bit a percentage) occurred in the higher end of our property markets

And moving forward, as affordability issues pitter-patter in for many Australians, behind the market will keep to outperform.

3. Rents will increment strongly

Increased rental demand at a time of very low vacancy rates will see rentals go on to rise throughout 2022.

And then when our international borders reopen this will further increase demand for rental housing.

If you retrieve virtually information technology…when people initially move to a country or region, about hire beginning.

In addition, when strange students return nosotros'll see increased pressure on apartment rents shut to education facilities and in our CBDs.

Yet despite the lack of clearing over the last few years, just look at how rentals rose – peculiarly for houses.

And every bit rise house rentals will create affordability issues for many tenants, apartment rentals will too increment in 2022.

4. Migration to Queensland will continue

Freed from the constraints of needing turn to upwards to a CBD part each day, and sick and tired of being locked down in our southern states many Aussies migrated toSouth East Queensland last year.

And at present that our borders have opened up and because the cost differential and the perceived lifestyle benefits it's likely that the northern migration will continue into 2022.

Add to this positivity off the back of employment growth and the long term benefits of hosting the Olympics and the actress infrastructure building that will occur, this part of Australia is looking particularly positive.

5. APRA is not done yet

The financial regulator will be carefully watching to see what the market does and be fix to step back in if information technology feels an overheated property market could be a risk to the financial arrangement

six. The Federal election will interfere.

If history repeats itself, the Federal election which will be held in May will stall the markets from the time it is appear.

And then life volition become back to normal whatever the eventual election outcome will be.

7. Employment volition remain robust

Our economy will keep growing and the unemployment rate should fall even though many new jobs volition be created but nosotros will remain challenged by the spread of the virus making for a lumpy yr.

Here's what the banks say most holding prices in 2022

At the end of last year, our 4 big banks updated their belongings price forecasts in response to the market'south resilience in the face of extended lockdowns.

Here are their belongings price forecasts for 2022 and 2023:

one. NAB has forecast a iv.nine% lift in property values in 2022 and a 4% autumn in 2023.

2. ANZ's outlook is a 6% price hike this year and a 4% drop in 2023.

3. The CBA expects house prices to rising 7% in 2022, and 10% side by side year.

four. Westpac expects an 8% rise in 2022 and a 5% correction in 2023.

Over the next two years, economic forces volition be unlike to the final few years.

The supply of homes on the marketplace for auction will be strong, Australians will exist back to travelling overseas and spending their money differently than in the pandemic years, which encouraged people to renovate, sell and upgrade the homes they were working in under lockdowns and in due course interest rates volition rise.

It is possible that the slower growth rates moving frontwards will mean a slowdown in debt accrual for Australian households, which may mitigate the need for further interventions by APRA.

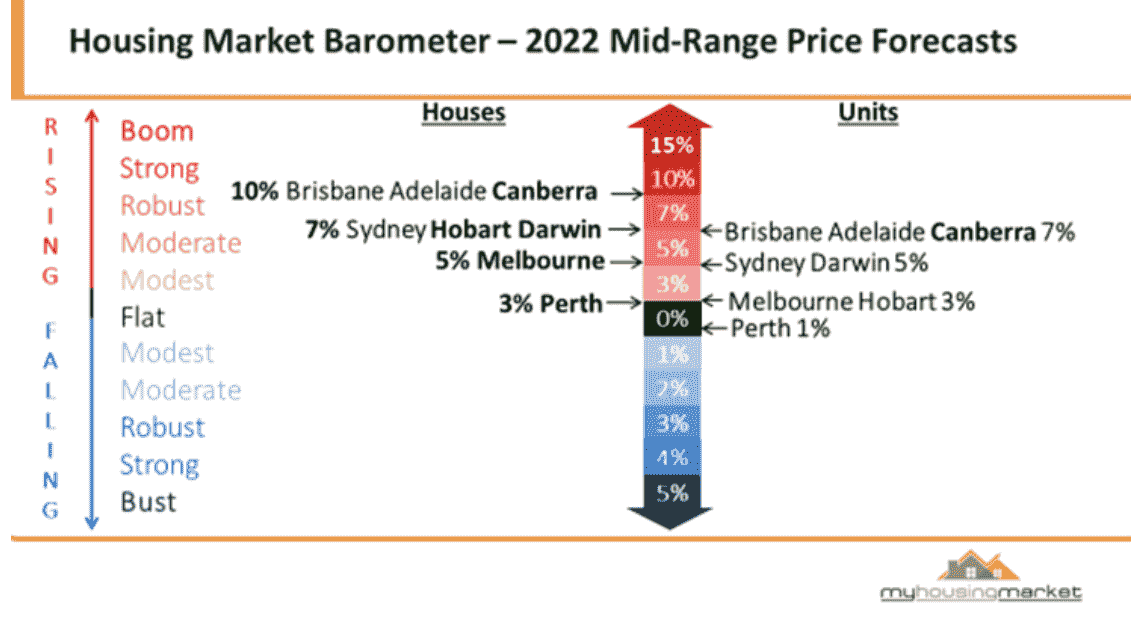

Dr. Andrew Wilson, Chief Economist of My Housing Market made the post-obit property market forecasts for 2022.

He recently commented that CBA's predictions of a potential 10% price autumn in 2023 due to ascent interest rates were " Simply Ridiculous."

This is what's been happening to Australian house prices over the last twelvemonth…

Source: CoreLogic, Apr 1st 2021

So how long will this bicycle go on?

Remember the electric current upturn phase of the belongings cycle actually only commenced in October 2020.

Usually the upturn phase of the property wheel lasts a number of years and is followed by a shorter boom stage which is eventually cut short by the RBA raising interest rates or by APRA introducing macro-prudential controls to dampen the exuberance of property investors and abode buyers.

Nonetheless, this fourth dimension around nosotros have experienced an unprecedented rate of growth seeing our belongings markets perform even more strongly than anyone ever expected, with the rates of house price growth at levels non seen for a number of decades.

While a lot has been said almost the +20% increment in belongings values many locations take enjoyed so far this cycle, information technology must be remembered that the last elevation for our property markets was in 2017 and in many locations housing prices remain stagnant over a subsequent couple of years which means that boilerplate toll growth was unexceptional over the long term, averaging out at effectually 5 per cent per annum over the terminal 5 years

But our fiscal regulator APRA instructed banks and other authorised lenders that from November 2020 borrowers will need to be able to come across repayments at to the lowest degree iii per cent college than the loan product rate to receive a loan.

If, for example, you apply for a mortgage with an interest charge per unit of ii.five per cent, the bank must now assess that you will still exist able to make repayments if the rate rises to 5.five per cent – rather than the previous serviceability supposition of 5 per cent.

These changes mean the maximum borrowing capacity for the average borrower will reduce by effectually 5 per cent.

Interestingly the new 3 per cent buffer charge per unit does not apply to non-depository financial institution lenders. However, APRA is considering including them in the future.

While tougher lending standards will certainly take some heat out of Australia's holding markets by restricting the number of people that can go home loans, or lessening the amount they tin can borrow, information technology seems similar the regulators are aiming to gently apply the brakes to the housing market, rather than slam them on.

Now I know some people are worried and wondering "Are the Australian property markets going to crash in 2022?"

They hear the perpetual holding pessimists who've been chasing headlines and telling everyone who's prepared to listen that the Australian property markets are going to crash and housing values could drib up to twenty% – simply merely look at the terrible track records – they've been predicting this every year for the last decade and they've been wrong.

Our property markets are just going to motion out of the sixth gear into third or fourth gear – they are not going into contrary.

Back to the question of when will, this property bike volition end – there is petty dubiety that Macro-Prudential controls will have a negative impact on our property markets and tiresome the rate of growth of housing values.

Later all, that'southward what they're intended to exercise.

Whether the markets will just experience slower growth or stop dead in their tracks volition depend on what measures are introduced.

Targeting debt to income ratios volition have a limited impact on higher wealth households, who oftentimes have multiple streams of income.

However, it will affect lower-income households and those purchasing holding for the kickoff time.

If you lot think most it, first home buyers don't have a "merchandise-in" of a previous dwelling house and therefore need to borrow higher loan to value ratios.

On the i hand, the authorities says it wants to encourage first dwelling house buyers, and on the other paw, it is encouraging the regulators to sideline them.

And then in the concurrently, it's but waiting and seeing what our regulators cull to do.

I hope they have learned from the results of previous interventions, otherwise, if history repeats itself, there will be some unintended consequences.

Sentry this infinite.

NOW READ: Seven reasons for optimism nigh our economic recovery.

Yet despite all the challenges, our housing markets just keep bounding along…

Source: CoreLogic, Apr 1st 2021

What'southward alee for our property markets?

Let'due south have a look at half-dozen property trends that I think will occur in 2022.

- Property need from home buyers is going to continue to exist strong

Currently, home prices are surging effectually Australia, auction clearance rates remain loftier, and the media keeps reminding the states we're in a property boom.

The result is emotions are running high at the moment, with FOMO (fear of missing out) being a common theme around Australia's property markets.

I of the leading indicators I watch carefully is finance housing approvals, and these are suggesting that more than Aussies are looking at getting into holding and we volition have strong ongoing demand from possessor-occupiers and investors over the side by side 6 months.

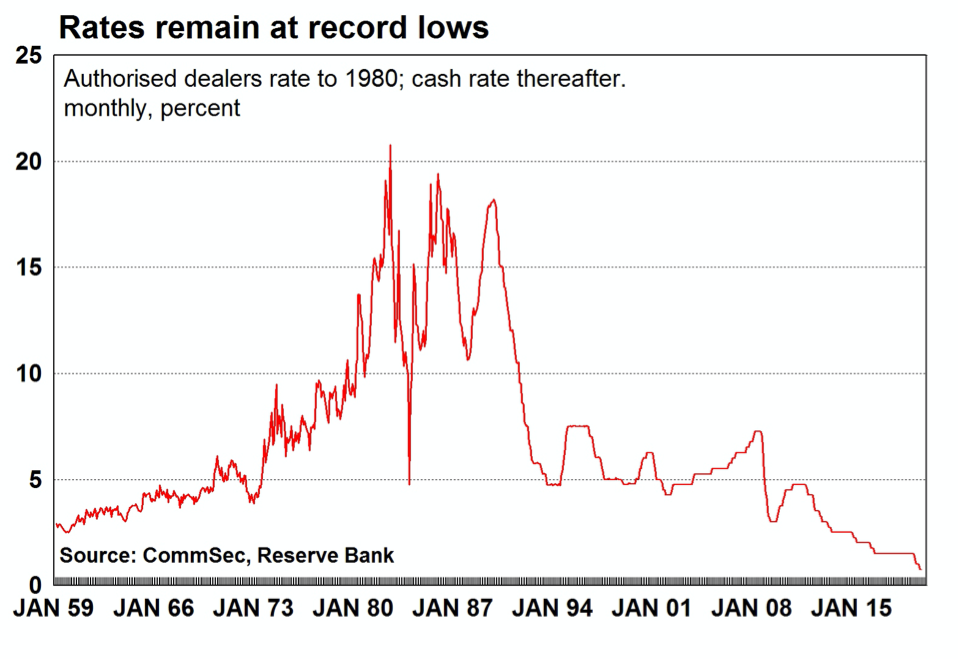

At present, with borrowing costs lower than they always have been, the reassurance from the RBA that interest rates won't rising for a number of years, it is likely that heir-apparent need will remain strong throughout 2022.

In fact, this is a self-fulfilling prophecy…

Every bit holding values increase and the media reports more positively almost our property markets, FOMO will hateful more buyers will exist keen to get in the market earlier it prices them out.

2. Investors will squeeze out start habitation buyers

While there were many first-time buyers (FHB'south) in the market in the first one-half of 2021, buoyed past the many incentives existence offered to them, at present demand from FHB's is fading as holding investors re-enter the market and property values rise.

Of form over the final few years, investor lending has been low, only with historically low-interest rates and easing lending restrictions, investors are back with a vengeance.

three. Property Prices volition go on to rise

While many factors affect property values, the main drivers of belongings price growth are consumer conviction, low-interest rates, economic growth and a favourable supply and need ratio.

Every bit ever, there are multiple real estate markets effectually Australia, just in general belongings values should increment strongly throughout 2022.

Every bit ever, there are multiple real estate markets effectually Australia, just in general belongings values should increment strongly throughout 2022.

All the same certain segments of the market will even so continue to suffer, in particular in the city apartment towers and adaptation around universities until nosotros get the influx of migrants and international students that the government is encouraged to return to Commonwealth of australia.

While overall vacancy rates are low and rents are rising, some rental markets will remain challenged – in item, the inner-city apartment markets which are reliant on students, tourists (AirBNB) and overseas arrivals.

Simply overall, Australia'south low mortgage rates continue to underpin very strong growth in belongings prices throughout the country.

Ongoing strength in housing finance, elevated auction clearance rates, and continued low stock levels propose housing prices volition proceed to ascent solidly through 2021.

4. People volition pay a premium to be in the right neighbourhood

If Coronavirus taught u.s. anything, information technology was the importance of living in the correct type of property in the right neighbourhood.

In our new "Covid Normal" world, people will pay a premium for the power to work, alive and play within a 20-minute drive, bicycle ride or walk from dwelling.

In our new "Covid Normal" world, people will pay a premium for the power to work, alive and play within a 20-minute drive, bicycle ride or walk from dwelling.

They will await for things such every bit shopping, business organization services, education, customs facilities, recreational and sporting resources, and some jobs all within 20 minutes reach.

Residents of these neighbourhoods have at present come up to appreciate the power to be out and about on the street socialising, supporting local businesses, being involved with local schools, enjoying local parks.

five. More expensive properties will outperform

The current holding cycle was initially characterised by all segments of the market rising – other than inner-urban center high-rise apartments.

But now the loftier stop of the market place is leading the growth in belongings values

In the three months to January, capital letter urban center homes saw the top 25% of values ascent 8.half dozen%, compared to 1.one% across the everyman 25% of values

6. This is a bike dominated by upgraders

The current belongings and economic environment, plus the scars left on many of us after a twelvemonth of Covid related lockdowns take meant that Aussies are looking to upgrade their lifestyle.

- Many tenants are no longer happy to live in small dingy apartments and with an crowd of rental units available in many areas, they are taking the opportunity to upgrade their accommodation.

- Other tenants who accept managed to salvage a deposit are taking advantage of many of the many incentives bachelor and are becoming first dwelling buyers.

- With record low-interest rates and surging belongings markets, many existing homeowners or upgrading their accommodation to larger homes in improve neighbourhoods. In fact, a contempo survey suggested that 1 in iii homeowners are looking to sell their homes in the next five years.

- While pocket-size group homeowners are upgrading their lifestyle and moving out of the big fume to regional Commonwealth of australia, more Aussies are looking to upgrade their lifestyle by moving to a better neighbourhood. As mentioned above, they beloved the thought that most of the things needed for a adept life are but around the corner.

- Many Baby Boomers are looking to upgrade their accommodation by moving out of their old, tired family unit home into big family-friendly apartments or townhouses. But they're non looking for a sea change or tree change, they're keen to live in "twenty-minute" neighbourhoods close to their family and friends.

What about the long term prospects for our belongings markets?

Currently, at that place are well-nigh 25.5 one thousand thousand Australians and in early 2021 the Government released the Intergenerational Report to help Australia and the businesses plan for the adjacent forty years –.

The IGR projects an Australian population of 38.eight million by 2060-61, and even though this is a little lower than previous projections – due to Covid slowing things down – this still means Commonwealth of australia'southward population is projected to grow faster than nearly other adult countries.

Despite the reduction of the projected population, these trends are truly monumental.

If you think nigh it, it's taken Australia well over 200 years since European settlement to achieve a population of 25.5 million people today.

But in the next 40 years, our population volition increase by around 13.3 1000000 people.

In other words, it will increase by over 50%!

To make this worse, currently, there are two.five people in each household, merely the IGR forecasts the boilerplate number of people in each household will shrink a little moving forward, significant we are going to require about a 3rd more existent estate than we currently accept.

To deal with the projected population growth between now and 2061 information technology's probable we're going to require one new property built for every two properties that currently exists!

All this means our manner of living is going to change considerably and town planners will struggle to cope with this growth.

Of grade, this will bear upon property investment choices, but strategic, knowledgeable investors will be well-placed to capitalise on the irresolute trends.

What this means is there volition be many more high-rise towers of apartments, not just in the CBD but in our middle-ring suburbs – we are already starting to see that especially in Melbourne and Sydney. And in that location volition exist lots more than medium-density housing – in particular townhouses volition be a pop way to alive with modernistic large accommodation on more than compact blocks of land.

It would exist foolish to try moving forward considering no one really knows what's going to happen to inflation and involvement rates, only as more than of u.s.a. want to live in the large majuscule cities of Australia, and in particular in those locations shut to the CBD or the h2o where in that location will exist more manatees, the scarcity will just push up the price of properties.

What'south alee for our economy?

Economical growth has predictably retreated over the September quarter, but the results were significantly better than the gloomy numbers that had been widely forecast.

This certainly kills stone dead the prospects of some other recession equally was too predicted past many.

The ABS reports that the national GDP contracted i.9% seasonally adjusted over the September quarter which particularly reflects the impact of the coronavirus lockdown is in NSW and Victoria.

State final demand contracted sharply over the September quarter in New South Wales by half dozen.five%, with Victoria downwards 1.4%, and Canberra falling 1.6%.

All other states, with the exception of Western Australia, reported stiff economic growth over the quarter.

With lockdowns having ended in October, the prospect of a sharp rebound in economic action is clearly likely over the Dec quarter with a sustained recovery set to continue over 2022.

Although challenges remain with the emergence of coronavirus variants, the Australian economic system has once more proven resilient with consumer conviction rising with the ending of coronavirus emptying policies through lengthy lockdowns.

Here are eight reasons to experience positive about our economic time to come

- The Reserve Bank Governor has committed to leaving the cash rate at 0.1 per cent till 2024. .

ii. While inflation has picked up, it remains low in underlying terms.

Inflation pressures are also less than they are in many other countries, not least considering of the only modest wages growth in Australia.

And chiefly, the Board volition non increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range.

This volition require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is probable to take some fourth dimension.

The Board is prepared to be patient, with the primal forecast being for underlying inflation to be no higher than 2½ per cent at the end of 2023 and for only a gradual increase in wages growth.

With inflation at best simply in the mid-range target at the stop of 2023 but wages growth to remain subdued by comparing, this continues to confirm that 2024 – at the earliest – remains the electric current RBA expectation for the next increase in official rates.

3. Unemployment is the focal point of all monetary and fiscal policy deportment.

And despite the concerns of what could happen to unemployment with the removal of Task Keeper, Australia's unemployment rate keeps falling.

Sure with the lockdown is in late 2021 unemployment took a hitting, but new task ads on SEEK rose 10.2% in October.

This followed on from the strong 8.8% month on calendar month rising in September.

Non surprisingly NSW, Victoria and the Act drove the upshot with those jurisdictions coming out of lockdown in the month.

This suggests labour demand is strong and should see the unemployment rate resume its pre-lockdown downward trend (after a picayune lag.)

4. The Westpac consumer sentiment index is at decade highs while business organization confidence is at 31-month highs.

Compared to prior downturns, the recovery in consumer sentiment is the sharpest seen in the history of the series and reminds the states of the unusual nature of this daze and the extensive government support provided to households and businesses.

5. The success in suppressing the virus has enabled our states and territories to 'reopen' their economies.

6. Governments, the Reserve Bank, commercial banks, and regulators have provided all the necessary back up and stimulus to ensure as many businesses as possible stay in business and workers concord onto jobs.

7. Borrowing costs for businesses, households, and governments are at 'rock lesser'.

8. The additional boost to confidence and future prospects comes from the prospect of a vaccine.

Risks to our economy include further waves of virus cases; setbacks with vaccines; policy mistakes on the removal of support measures; and an extended delay in the re-opening of strange borders.

Compared to prior downturns, the recovery in consumer sentiment is the sharpest seen in the history of the series and reminds u.s.a. of the unusual nature of this stupor and the extensive authorities back up provided to households and businesses.

We're spending more than

The major banks regularly report their internal data on credit card spending and consumer activity which has lifted strongly over the last few months in part due to the opening upwardly of Victoria but consumer spending is also potent in other states.

Going forrard, consumer spending faces headwinds from elevated unemployment, weak wages growth, tapering income support, and weak population growth.

The government recognises that consumer spending is a key driver of economic activity and that'due south one of the reasons it is then keen to reduce unemployment and back up our economic system.

Property markets are booming

When Australians feel comfortable and confident almost the value of their homes, their castle, they feel a wealth effect that encourages them to spend more.

The Stock Market is Rallying

Rising stock prices are important for several reasons – they prove investors are confident in the earnings and profits of the business organisation sector and they boost the wealth of shareholders which underpins confidence and spending.

A vaccine rollout is happening and boosting confidence

What nearly business firm prices?

Interestingly all the depository financial institution economists concur that it is likely that all our capital cities will experience stiff house price growth over the next couple of years with firm prices ascent 20% to 30% over this holding cycle.

Of class, at that place isn't one Australian belongings market, or one Melbourne or Sydney property market and then certain segments of the market will outperform.

In particular, the more than affluent suburbs of our capital cities where residents have higher wages growth and more cash stashed away from the Covid pandemic are likely to outperform.

Of course, at times like this, forecasting median firm values are of petty value.

Instead, one needs to get more granular to really understand what is really going on.

Each state is divided into multiple markets, by geography, cost point and type of accommodation.

Each of our capital cities has an inner and about CBD property market place, an inner suburban marketplace, a group of middle-ring suburbs, and outer suburban property markets.

And then there are apartments – either high-rise or medium-density – townhouses, villa units, and houses.

There are also new and establish property markets.

And each of these market place segments behaves differently.

Currently, most of the property sales occurring are in the lowest toll points with few discretionary sellers in the more established suburbs and higher bracket suburbs.

This means that the palette of properties currently being sold is generally in the lower price bracket and this alone volition bring downwardly reported median home values.

But this doesn't accurately reverberate the value of particular backdrop in any specific market place, but more of the types of properties being sold.

Nosotros regularly report heir-apparent demand equally being shown by realestate.com.au's Monthly Search Report and as you can see from the chart below, buyer demand is considerably higher than a yr ago, fifty-fifty though this nautical chart shows how enquiries have slowed down and nosotros've moved from a "white-hot marketplace" to a "ruddy hot" market.

Moving forward some areas will strongly outperform others

The coronavirus pandemic has forced all Australians to reevaluate how nosotros alive our lives.

Offices were shut, lockdowns were in place, and moving frontward people are likely to continue working at home more than than ever.

This means gone are the days where our 'home' was simply the place we rest our heads and bask some downtime betwixt piece of work and our social lives – the coronavirus social distancing has put an end to life as nosotros once knew it.

If social distancing and the Covid-xix environment have taught us anything, it has taught united states the importance of the neighbourhood we live in.

If you can exit your home and be within walking altitude of, or a short trip to, a slap-up shopping strip, your favourite coffee shop, amenities, the beach, a great park, the recently implemented coronavirus restrictions might seem a little more than palatable than if you had none of that on your doorstep.

That's why choosing the right neighbourhood is of import for property investors?

In short, it's all to do with majuscule growth, and we all know majuscule growth is critical for investment success, or merely to create more than stored wealth in the value of your domicile.

Certain there is always the opportunity to add value through renovating your belongings or making a quick buck when buying well.

Merely these are off'south and won't make a long-term difference if your property is not in the right location because you tin can't modify its location.

This is key considering nosotros know that 80% of a property's performance is dependent on the location and its neighbourhood.

In fact, some locations have even outperformed others by fifty-100% over the past decade.

And it'due south likely that moving forward, thanks to the electric current environment, people will identify a greater accent on neighbourhood and inner and heart-ring suburbs where more than affluent occupants and tenants will be living.

These 'liveable' neighbourhoods with shut amenities are where uppercase growth will outperform.

How do we place these locations?

What makes some locations more than desirable than others?

A lot has to do with the demographics – locations that are gentrifying and likewise locations that are lifestyle locations and destination locations that aspirational and flush people want to live in volition outperform.

It's well known that the rich exercise non like to travel and they are prepared to and can afford to pay for the privilege of living in lifestyle suburbs and locations with a high walk score– meaning they accept easy admission to everything they demand.

So lifestyle and destination suburbs where in that location is a wide range of civilities with 20 minutes walk or drive are likely to outperform in the futurity.

At the aforementioned time, many of these suburbs volition be undergoing gentrification – these will be suburbs where incomes are growing, which therefore increase people'south ability to afford, and pay higher prices, for holding.

A good neighbourhood ways different things to different people, but there are some primal factors that help to determine which locations have the potential to grow in value faster in the time to come.

More often than not, a proficient neighbourhood is determined past the physical location, suburb character, and its close proximity to amenities such equally a shopping strip, park, coffee shops, teaching, and even some jobs.

It'due south obvious so that in our new 'Covid' world, people volition want to be in a location where everything they need is in brusque xx-infinitesimal proximity – whether that is on public transport, bike ride or walks – to their home.

In planning circles, this concept is known as the '20-minute neighbourhood'.

Many inner suburbs of Australia's uppercase cities and parts of their middle suburbs already meet the 20-infinitesimal neighbourhood tests, but very few outer suburbs do because at that place is a lower developmental density, less diversity in its community, and less access to public transport.

Supply and demand

Rising property prices are the effect of ii basic economic concepts: "Supply and Demand" and "Aggrandizement".

Notwithstanding, there is a sub-component of Demand, called "Chapters-to-Pay", which is often overlooked.

Understanding how these concepts work together to affect real estate is crucial to one'due south belief or doubt about whether real manor values volition rise.

In a complimentary-market place economic system, prices of any commodity will tend to drop when supply is high and need is low.

In other words, when there is more than than enough of something, information technology is said to exist a "buyer's market" because sellers must compete, typically past lowering the cost, to concenter a heir-apparent.

Conversely, when supply is depression and need is high, prices volition tend to ascent as buyers bid upwardly pricing to compete for the limited supply. This is called a "seller'due south marketplace".

Allow'due south look at it this way….

- With regard to supply …. they aren't making whatsoever more than real estate in the almost desirable areas and by this, I'm talking about the clay, non the buildings.

- With regards to need , Australia has a business concern plan to increment of population to 40,000,000 people in the next xxx years.

For the last few decades, continued strong population growth has been a cardinal driver supporting our holding markets.

Commonwealth of australia'south population was growing past around 360,000 people per annum, significant we needed to build around 170 to 180,000 new dwellings each twelvemonth to suit all the new households.

Since lx% of our growth is dependent on immigration, in the brusk-term population growth will fall, but they should increase again as soon as overseas immigrants volition be allowed to come up to our shores.

All the same, more than and more ex-pats are returning to Australia.

At the same fourth dimension, the number of new properties listed for sale in our capital cities is falling creating an imbalance of supply and demand

Source: Corelogic Apr 2022

What about affordability?

With interest rates at celebrated lows, housing affordability is every bit inexpensive equally information technology always has been.

I'm non proverb the properties are cheap – they never have been if yous want to live in great locations in major world-class cities.

Merely for those first dwelling house buyers wanting to get a foot on the property ladder, established home buyers wanting to upgrade, or investors looking to concord onto a property, the belongings costs are less than they ever have been.

And the RBA has declared that the interest rate will not increase until unemployment is back to within its preferred range of around 4.v%.

They have said this volition exist unlikely to occur in the side by side three years.

In other words, we are in unprecedented times where we don't have to worry nigh ascension involvement rates in the foreseeable future

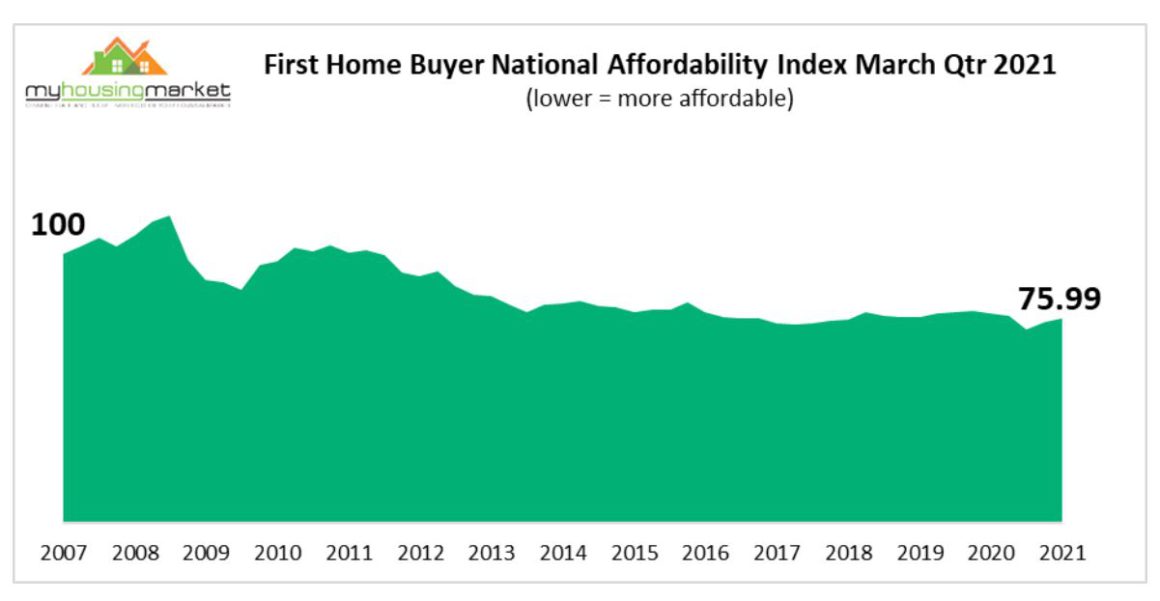

Of course, rising property prices are an increasing issue for First Home Buyers who are not bringing a "trade-in" to the market.

Every bit opposed to an established homebuyer who has a "trade-in" that is increasing in value, if commencement home buyers wait to become into the market they're finding the marketplace moving faster than they can salve, so they're hopping on lath the property train every bit quickly as they can.

Starting time home buyer affordability has declined for the second sequent quarter according to Dr. Andrew Wilson, reinforcing the latest ABS data that revealed first habitation buyer numbers – although still strong – have fallen over recent months.

Australian house price forecasts

In the medium term, property values will be linked to the extent that our economic recovery affects income, employment, borrowing capacity, and credit availability.

However, I'm comfy with the underlying long-term fundamentals supporting our property markets in the medium to long term.

Let's look at a couple of them…

- Population growth

Equally I said, in the short-term population growth will fall, but this should increase once again at present that the gates have been opened and over 200,000 overseas immigrants will exist allowed to come up to our shores.

Of course, Australia is probable to exist seen as one of the safe haven's in the world moving forward.

- Declining housing supply

The oversupply of dwellings in many Australian locations is now dwindling and there are very few new large projects on the drawing lath.

Considering how long information technology takes to build new estates or large flat complexes, we're going to experience an undersupply of well-located backdrop in our capital cities in the next yr or two.

- Involvement rates are low

The prevailing low-interest-rate environment is making it easier to ain a dwelling, either every bit an owner-occupier or investor.

In fact, it'due south never been cheaper for investors to own a holding with the "net outlay" – the out-of-pocket expenses – beingness the lowest they've been for decades considering how inexpensive finance is today.

- Smaller households are condign the norm

Sure many people live in a multigenerational household, but pretty soon Millennials volition brand up 1-third of the property market place and their households tend, in full general, to be smaller as are the households of the booming 65+ year old demographic.

More 1 and two people households mean that moving forward, we will need more dwellings for the aforementioned number of people.

- More renters

Soon 40% of our population will exist renters, partly because of affordability bug but as well because of lifestyle choices.

The government isn't providing accommodation for these people. That's up to you lot and me as property investors.

- Investors are back in the market with a vengeance.

- The underlying economic fundamentals are stiff

- And Australia'south cyberbanking system is strong, stable, and sound.

Fifty-fifty though a few home buyers accept overcommitted themselves financially, in that location should be no real concern about household debt because, in general, information technology is in the hands of those who can afford it.

There is currently a very low rate of mortgage default of mortgage to increase.

Sydney House Price Forecast

Sydney has one time over again recorded one of the largest rises in housing values over the month, but information technology's also the metropolis that has recorded the sharpest reduction in the pace of capital gains from before highs.

Sydney is the most expensive capital city past some margin and information technology'due south also been the city where values accept risen the almost over the first 7 months of the year.

Worsening affordability is probable a key contributing factor in the slowdown here, forth with the negative bear upon on consumer sentiment as the city moves through an extended lockdown flow.

Sydney house values are at present up 25.v% over the past twelve months, while unit values are upward less than half that rate, with a 7.6% rise in values over the year.

In fact apartments in high supply areas such as the cookie-cutter high rise CBD towers present a significant adventure to property investors.

This trend already occurred prior to COVID-nineteen when certain areas in Sydney experienced major unit oversupply.

Information technology seems the belongings investors are slowly understanding the risks associated with high-ascension tower apartments in Sydney including potential construction defects, loftier vacancy rates, lack of scarcity, lack of upper-case letter growth, and the challenges of ownership in buildings that are predominantly owned by investors, and oft many overseas investors.

Real estate in Sydney'due south larger regional locations, and in particular in lifestyle locations like Byron Bay, the Central Coast, the Hunter Valley, Wollongong, New South Wales s coast should perform strongly this year with beachside suburbs likely to outperform the wider overall market

The resurgence of heir-apparent and seller interest in the Sydney property market has meant that auction clearance rates have consistently been in the high 70% – 80% range suggesting at that place are more buyers than in that location are sellers and this always leads to higher property prices

More investors are getting into the Sydney market place now recognising that there are no bargains to be found and that in 12 months time the properties they purchased today will await like a bargain.

Certain at that place are fewer good properties for auction at the moment, and many of the practiced ones are for sale off-market, however, if y'all'd like to know a bit more than about how to find these investment gems requite the Metropole Sydney team a call on1300 METROPOLE or click hither and leave your details.

Melbourne House Price Forecast

Melbourne's housing market slowed down at the stop of 2021 rising but 0.8% over the last quarter but, having said that Melbourne housing prices are at new record highs having increased 14.9% in the terminal twelvemonth.

The softer performance relative to other regions is due to a few dissimilar factors including weaker unit of measurement market conditions where values are up past 5.6% over the yr, weaker demographic trends equally population growth is negatively impacted by airtight international borders and stronger migration to the regional areas of the state and a more significant touch from COVID outbreaks and associated lockdowns.

At Metropole we're finding that strategic investors and homebuyers looking to upgrade are actively out picking the eyes out of the market.

While overall Melbourne property values are likely to increase strongly once again in 2022, like all our uppercase cities there is not ane Melbourne holding market place, and A-grade homes and investment-grade properties are likely to outperform.

Sure in that location are fewer good backdrop for sale at the moment, and many of the adept ones are for sale off-marketplace, nevertheless, if you'd like to know a bit more about how to detect these investment gems requite the Metropole Melbourne squad a call on1300 METROPOLE or click here and exit your details.

Brisbane House Price Forecast

Brisbane was the strongest holding marketplace in 2021 exhibiting astonishing growth, with many locations experiencing thirty+% house price growth.

Housing values rose 2% over the past month – in dollar terms, nearly $15,000 was added to the Brisbane median value over the month of March.

And even though growth is slowing in other parts of Australia, Brisbane's housing markets is continuing to perform strongly this year.

Sure it recently suffered from devastating floods, but history shows the resilience of the Brisbane property marketplace which bounces back speedily.

It seems the floods acted as a circuit breaker for the white hot Brisbane housing marketplace, just our on the ground experience at Metropole Brisbane is that the market place is still going going gangbusters.

In that location just are not enough new properties coming onto the market place for auction to satisfy the many habitation buyers and investors wanting to purchase in Brisbane.

Every sub-region of Brisbane has seen housing values ascension by more than 20% over the past twelve months, however, information technology is the coastal markets of Due south East Queensland where growth has led the land, with housing values surging 32% higher over the year beyond the Sunshine Coast and thirty% higher on the Gilded Coast.

The long term outlook for Brisbane's housing markets is also looking positive, with a stiff demographic trend fuelled by interstate migration, a big infrastructure budget, and a burgeoning level of excitement following the announcement that Brisbane would host the 2032 Olympic games.

Similarly, popular areas of the Gilt Coast and Sunshine Coast have enjoyed potent need considering the increased flexibility of being able to work from home and commuting to the big fume less frequently.

At the same time, property investor activity has been strong, peculiarly for houses, not only coming from locals just from interstate investors who see strong upside in Brisbane property prices too as favourable rental returns.

However, there is non one Queensland belongings market place, nor one south-eastward Queensland property market, and dissimilar locations are performing differently and are likely to continue to do so.

Houses remain a firm favourite of prospective home hunters, with demand rising post-lockdown and it remains significantly elevated compared to last twelvemonth.

Nevertheless, apartment demand has been sliding and, in general, apartments in Queensland are a college take a chance investment than houses, especially due to a high supply of apartments that are unsuitable for families or possessor-occupiers.

In summary…

Brisbane is likely to be ane of the best performing property markets over the next few years, but while some locations in Brisbane take strong growth potential, the right properties in these locations will make swell long-term investments, sure submarkets should exist avoided like the plague.

Now read:Brisbane belongings markets forecast for string growth

Our Metropole Brisbane team has noticed a significant increase in local consumer confidence with many more homebuyers and investors showing interest in a property.

At the aforementioned time we are getting more enquiries from interstate investors there we have for many, many years.

If you'd like to know a bit more about how to detect investment grade properties in Brisbane please give theMetropole Brisbane team a call on1300 METROPOLEor click here and leave your details.

Canberra House Cost Forecasts

Canberra's holding market has been a "tranquility achiever" with median house prices recording the biggest jump in prices across all of Australia's capital cities, at a huge 25.v% in but i year or 3.7% over the quarter, to a new median of $1.015 meg according to Domain's Firm Price Study.

That means that prices soared by almost $ane,054 a day over the June quarter to give a total ascension of $96,000.

This is the steepest price acceleration in near 3 decades, the Domain report explained.

Median firm prices in the inner northward, inner due south, and Woden Valley are now all above vii digits.

But unit price growth has been more restrained as the development blast of recent years contains prices, although they are edging closer to a record high, up a more small-scale $18,000 (or iii.6%) over the June quarter to $504,217.

Interestingly, since the pandemic, Canberra business firm prices take risen a huge thirty.nine% and unit prices 9.4%, which is the highest rate of growth across all of Commonwealth of australia's cities.

Perth Business firm Cost Forecast

Perth housing values accept recently shown a renewed growth trend, with the monthly growth rate lifting to one% in March, the strongest monthly reading since May of last year.

The re-acceleration in housing values may be attributable to stronger internal migration rates equally state borders take reopened, along with the strongest jobs growth of whatever state over the past year and the virtually affordable housing prices of whatever state capital.

With the Perth median house toll ascension, stiff rental atmospheric condition, and high rental yields along with improving demographic and economical conditions, it's probable the Perth housing market volition keep its upward trajectory for the rest of the year.

With the Perth median house toll ascension, stiff rental atmospheric condition, and high rental yields along with improving demographic and economical conditions, it's probable the Perth housing market volition keep its upward trajectory for the rest of the year.

Just the attractive property prices in Western Australia practice not mean that investors should jump into the Perth property marketplace – there are ameliorate opportunities in other parts of Australia.

The problem is the Western Australian economic system is too dependent on one industry – the mining manufacture and much of this is dependent on China, and this has a direct knock-on effect on WA firm prices.

Without structural changes to the W.A. economic system, it is unlikely to be able to deliver the significant number of higher-paying jobs and the substantial increment in population growth required to go along driving stiff housing price growth in the medium to long term.

Hobart House Price Forecast

Hobart was the darling of speculative property investors and the best-performing property market in 2017-8, and while dwelling values reached a record high in February 2020, its boom was interrupted by Covid-19.

Hobart property values are moving up again with values up to new record levels of 27.7% over the past year.

Adelaide House Cost Forecast

Adelaide housing values were up 2.6% in December taking the annual growth rate to 23.two%, the highest level since the Global Fiscal Crisis.

Housing demand has surged beyond Adelaide with the number of home sales over the by year the highest since 2002.

With need at the highest level in nearly two decades, advertised supply levels are around tape lows.

Market conditions have been far from even, with house values, which are up 23.ix% over the twelvemonth, rise at three and a half times the pace of unit values.

There is besides a remarkable difference in growth rates geographically, ranging from a 34.2% surge in values across Burnside to a 4.iv% increment across Adelaide city where the performance has been weighed down by a weaker unit sector..

You may as well be interested in reading:

- What can history teach united states of america most what'southward ahead for property

- How to Choose a Property Advisor

- What'due south ahead for Brisbane's property market?

- Property Investment In Sydney – 20 Marketplace Insights

- Belongings Investment In Melbourne – 29 Real Estate Market Tips

What The Market Recognizes As The Change In Value An Improvement Makes To A Property Is Called What?,

Source: https://propertyupdate.com.au/property-predictions-for-2022-revealed/

Posted by: registerguried.blogspot.com

0 Response to "What The Market Recognizes As The Change In Value An Improvement Makes To A Property Is Called What?"

Post a Comment